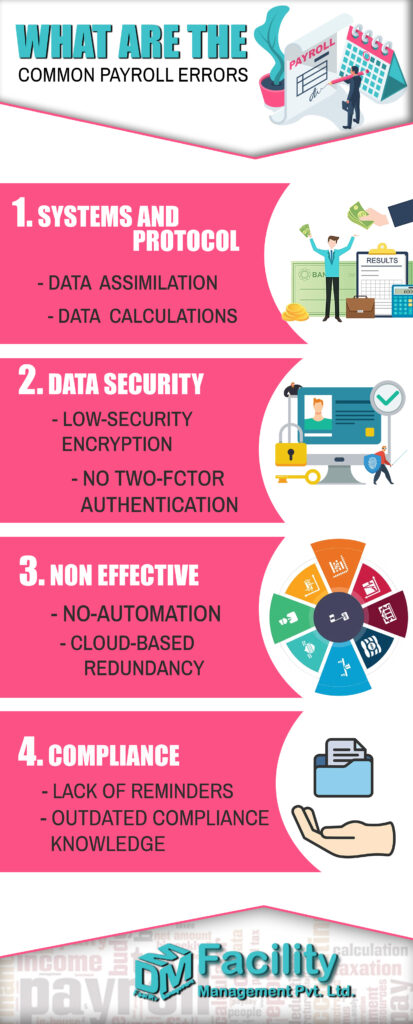

COMMON PAYROLL MANAGEMENT SYSTEM ERRORS AND THEIR EFFECTS

Feb 10, 2022

Payroll is one of the most quintessential parts of a business and a company and a business stands and relies on payroll to keep its operations running. Hiding a payroll management system from a payroll services company can make a huge difference in the operations of a company and can prevent common errors. You can always take a look at a guide to payroll management, which will help you understand payroll better. Let us look at a few common errors and learn how you can avoid them by implementing payroll systems.

Work role mismatch –

This may seem like a simple error but this is one of the most important aspects of a business. Managers ought to be able to classify the right designation for the right worker and failing to do so can cause a lot of trouble and a lot of reputation loss for the business. When this kind of an error happens the permanent worker gets classified as a temporary worker and gets the payment of a temporary worker and vice versa and due to this the workers can get quite upset and that can even bring the company’s balance into existence. With our excellent payroll management systems, there will never be a risk of this kind of mismatch that used to be common when there were no payroll management systems in place and payroll was done manually.

Payment inaccuracies –

This is also a major issue relating to payroll errors and this is perhaps one of the most fatal errors that a company can make and that is inconsistent payment. Inconsistent payment means not paying the worker the right amount at the right time and that can lead to work dissatisfaction this can cause the entire team of employees to lose morale and losing morale is never good for a business. Our payroll systems make sure that the right person gets paid the right amount at the right time and we make sure of this by to our automated systems and our manual oversight of them so that there is a 0% chance of error.

Flawed records –

Record keeping is important for a business because it keeps track of every analytical data that is related to the business growth and assessment of the business performance. Maintaining and updating these records will help a company understand how it is performing in the general industry and bad maintenance can even mean a bad budget allocation as well as many other errors. We not only e assist with your payroll but we also have systems in place that do excellent record keeping so you do not have to worry about outdated and error-riddled records.

Tax calculation –

As with payment accuracies, failure to do tax calculation can also land the company in hot water. Doing tax is necessary for a brand to stay in the good books of the revenue department of the country and incorrect tax calculation and incorrect tax submission can even make the company look suspicious in the eyes of the government authorities and can create unnecessary trouble for the brand and even damage the reputation of the brand for failing to comply with taxes. We have text calculating experts who are experienced enough to take this very seriously and offer you tax calculation solutions that will ensure that your brand image stays intact.

Compliance issues –

Payroll compliance is what keeps payroll systems planning and these compliances are mandates issued by the government to ensure that a company is competent to provide payroll to employees. These compliances include provident funds as well as gratuity and if the company fails to comply with these then they cannot issue payroll to employees and thereby cannot operate properly. We will make sure that all your compliance is in order so that you do not incur fines and restrictions by the government

These were a few common payroll errors that can be easily rectified with the payroll management system and services offered by us at DMM Facility Management Pvt Ltd. We are payroll experts and will ensure your payroll is always in order.